![]() Note: Files are in Adobe (PDF) format.

Note: Files are in Adobe (PDF) format.

Please download the free Adobe Acrobat Reader to view these documents.

Condensed Consolidated Statements Of Comprehensive Income

(The figures have not been audited)

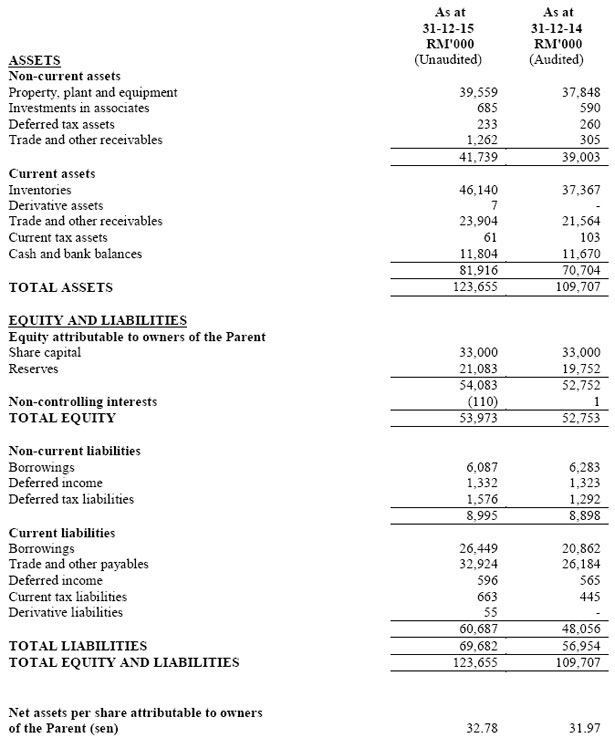

Condensed Consolidated Statements Of Financial Position

(The figures have not been audited)

Review of performance

12-month year ended 31 December 2015Group revenue at RM154.6 million was 1% higher compared with RM153.5 million of the corresponding year while Group profit before tax ("PBT") at RM4.6 million was 12% higher compared with RM4.1 million of the corresponding year. The increase in revenue and PBT was due to higher contribution from optical and related products division. Consequently, the Group recorded profit after tax of RM1.2 million, 9% higher compared with RM1.1 million of the corresponding year.

Optical and related products segmentOptical and related products segment continued to be the main contributor of Group revenue with contribution of 85% for the current year. The division attained higher number of outlets during the year at 109 (2014 : 89) resulting in higher outlet revenue at RM130.9 million compared with RM126.8 million of the corresponding year, representing an increase of 3%. With the achievement of higher revenue coupled with higher purchase rebate income from suppliers, profit before tax was recorded at RM11.9 million, 18% higher compared with RM10.1 million of the corresponding year.

Franchise management segmentRevenue at RM3.7 million was lower by 7% compared with RM4.0 million of the corresponding year. The decline in revenue was attributed mainly to lower royalty fee income as a result of lower retail sales attained by franchisees. Profit before tax at nil was 95% lower compared with RM0.4 million of the corresponding year due to higher operating costs incurred following the internal restructuring of staff to the division from optical and related products segment.

Food and beverage segmentThe division recorded revenue at RM18.6 million, 11% lower compared with RM21.0 million of the corresponding year. The decline in revenue was owing to intense market competition, closure of a bakery outlet since March 2015 and lower revenue contribution from the restaurants' business. Operating loss at RM7.1 million was higher by 12% compared with RM6.3 million of the corresponding year due largely to loss on disposal of restaurant business and impairment of assets.

3-month quarter ended 31 December 2015Group revenue and Group profit before tax (“PBT”) was higher by 8% and 91% respectively compared with the corresponding quarter. Higher revenue and PBT attained was contributed by the optical and related products segment.

Prospects

The country's economy expanded by 4.5% in the fourth quarter of 2015, lower than 4.7% in the third quarter of 2015, supported mainly by private sector demand and private sector continued to be the key driver of growth during the quarter. Private investment grew by 5% (Q3:5.5%), driven by capital spending in the manufacturing and services sectors. Private consumption expanded by 4.9% (Q3:4.1%), supported by stable wage growth and labour market conditions.

The Group still sees some pressure on consumers' purchasing power amid the weak consumer sentiment. Having said this, the optical and related products business will continue to expand its distribution network to increase market share and revenue with stores of various concepts. For the franchise management business, the Group will be selective for its new entry and focus on enhancing the business operation of franchisees. As to the food and beverage business, concerted effort will be placed to strengthen the operation and at the same time, the Group will also open new doors at selected locations and expand its franchise business.

Going forward, global growth is expected to remain moderate. Locally, domestic demand will continue to be the main driver of growth, supported mainly by private sector activity. The Group is cautiously optimistic to deliver a satisfactory performance for the year 2016 ahead.